Why Bitcoin changes real estate markets; 10 defects of investment property identified by Michael Saylor

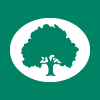

With a market cap below $1 trillion, Bitcoin only represents a fraction of a percentage of global wealth in 2023. Will its adoption really impact real estate, the most valuable asset class of all?

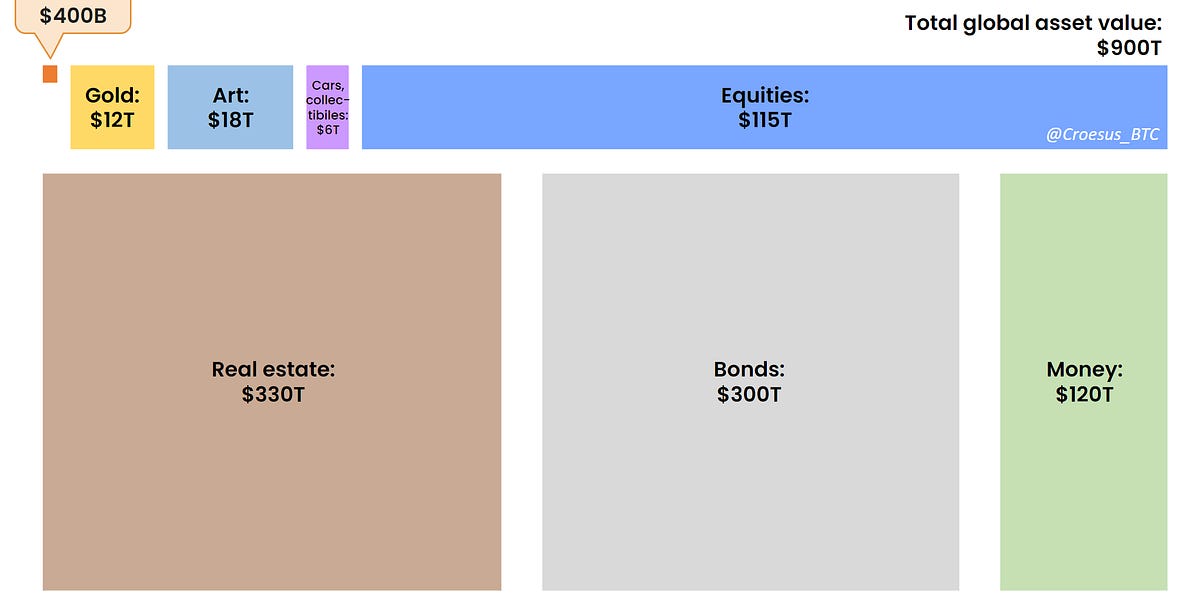

A constructive approach when appraising Bitcoin's economic impact is to compare and contrast it with other asset classes and forms of property. The big four are currencies, bonds, equities and real estate. As an emerging alternative, Bitcoin is the first and best-recognised digital asset. Appreciating the global asset landscape first can help to frame Bitcoin. As it turns 15, it's starting to reframe perspectives on the traditional asset classes.

"Our thesis is that Bitcoin is digital property, but without the risks and the liabilities of commercial real estate. It’s a digital commodity without the risks and the liabilities of gold. It’s a digital tech investment without the risks and the liabilities of big tech."

Michael Saylor, 2023 CNBC

Due to the popularity of investment property in Anglo-American culture, real estate is one of the better-understood asset classes. It's also the largest by value, worth in the region of $330 trillion (one-third of global wealth). In an interview on The Bitcoin Layer, Michael Saylor used Bitcoin's properties to highlight several defects with investment property as a store of value. Whilst his stance might be tied to his own (and his company's) significant Bitcoin holdings, Saylor has quickly become a thought leader when it comes to Bitcoin's place in the global asset landscape. His bias aside, Saylor's prolific and very public Bitcoin advocacy has certainly boosted debate.

This article introduces the conditions which have caused the monetisation of assets and puts real estate's current monetary premium into context. By interpreting Saylor's insights, it then compares and contrasts investment property and Bitcoin as stores of value. This exploration is an invitation to consider how Bitcoin adoption is contributing to the demonetisation of real estate.

The monetisation of assets, how did we get here?

Returns on savings have trended downwards over the last generation, but they have generally been higher than the rate of inflation.

However, the returns on savings accounts have remained below the rate of inflation for 8 out of the last 10 years, even when using the government-reported rate. Nominally, we've had a bounce in interest rates, but in real terms, they remain negative.

Considering the trends of interest rates and inflation, holding cash has become a sure way to lose purchasing power. There's a strong incentive to use other assets in an effort to preserve wealth. The idea of investing, or "making your money grow" has been normalised for the average person to the point where saving and investing have been conflated. After holding enough currency to cover a few months of expenses, a "diversified portfolio" has become the de facto store of value.

"in the absence of sound money, if fiat currency [...] is not holding purchasing power, then rational actors - be they corporations, individual investors, or families - will tend to take their weak currency or their weakening currency, and they will want to invest it in some stronger asset that will be a store of value."

Michael Saylor, 2022 The Bitcoin Layer

Bricks and mortar, safe as houses.

With its perceived security and stability, real estate has become synonymous with storing value and preserving wealth. Investment property has become a popular alternative asset alongside a diversified portfolio of stocks and bonds.

"Property is the world’s biggest store of wealth. Residential has pushed its value to new heights. The value of all the world’s real estate reached $326.5 trillion in 2020, a 5% increase on 2019 levels and a record high."

Savills, 2021

In a healthy market, the value of residential real estate to an investor is determined by expected future cash flows, mortgage rates, and the flow of new supply coming up for sale. Professional investors scrutinise these factors when analysing opportunities, and aim to understand the true utility value of a property. The buy-to-leave trend in the UK is evidence of capital being allocated to residential property on a speculative basis, completely detached from conventional factors.

For would-be homeowners, prices have become increasingly detached from the reality of typical incomes. Whilst average house prices used to be a multiple of three to four times a typical household income, in London they're now at a multiple of fourteen. Several economists, investors and commentators are warning of a global bubble. The theme of real estate accruing a monetary premium is lesser discussed, but the idea is straightforward: the search for a reliable store of value has turbo-charged the inflation of property prices far above their utility value.

With residential real estate in particular, there are many amateur speculators and investors in the market. The appeal of putting cash into investment property to preserve or build wealth is sweetened by the idea of "passive income" from rents. You might have heard your hygienist complaining about the student tenants in their buy-to-let property, your solicitor mentioning their Airbnb, or that a local business owner has been busy renovating their second home at the weekend. In the UK, around one in twenty people in the adult population are landlords, and one in ten own multiple properties.

It's interesting to consider how many investment properties and second homes would have been purchased by amateur investors if savings weren't expected to lose value. Does the average wealthy person, busy with a job and other responsibilities, really want to be a property manager and investor in their spare time? Perhaps if returns on savings accounts were beating inflation, more of the investing would be left to professionals. People might have a little more free time, and property would have less of a monetary premium.

Real estate's monetary premium.

Considering the functions of money - as a store of value, a medium of exchange, and a unit of account - our currency has been impaired. No longer a store of value, it has been demonetised, and this critical function has been channelled into other asset classes. In an environment of negative real interest rates, a rise in speculators and part-time property investors has contributed to the part monetisation of real estate markets.

Even if the monetary premium on property was a single-digit percentage of the overall market capitalisation, this would represent trillions of dollars of malinvestment around the world. In the UK real estate market, housing alone is worth ~£8.7 trillion. A single-digit percentage of monetary premium in housing would represent a malinvestment to the tune of hundreds of billions of pounds.

Is Bitcoin really a store of value?

Unlike real estate, Bitcoin's characterisation as a store of value is still hotly debated. Sceptics often point out its price volatility and lack of utility or 'intrinsic value'. They also cite regulatory and technical risks as reasons to steer clear. However, people's opinions about Bitcoin are evolving. Fidelity have emerged as a credible voice in the digital asset space, and they frame Bitcoin as a monetary good. Their polished research papers present a compelling investment thesis for Bitcoin as a store of value in our digital world.

Bitcoin's short-term price volatility is notorious, but investors who have held it for more than 5 years have never lost out. From the perspective of Austrian economics, all value is subjective rather than intrinsic. To an open mind, the long-term performance of Bitcoin to store or grow wealth is becoming impossible to ignore.

JUST IN: Chairman and CEO of Vanguard Group Tim Buckley says the firm won't join the #Bitcoin ETF race, as Vanguard claims to be focused on asset classes with an intrinsic value and capable to generate cash flows, like equities and bonds 🤔 pic.twitter.com/Q3kwDoS61G

— Bitcoin News (@BitcoinNewsCom) November 5, 2023

Asset Class Returns since 2011... pic.twitter.com/zMprB8gcxN

— Charlie Bilello (@charliebilello) September 30, 2023

The defects of investment property as a store of value

Below, a valid BIP39 12-word mnemonic seed phrase, which may or may not hold 47 BTC:

Would you rather own an investment property worth ~£1.4 million, or ~47 bitcoin?

Five years ago, the overwhelming majority of people would snap at the opportunity to invest in property. In 2018, the idea of speculating in a pyramid scheme and the mother of all bubbles was pretty easy to dismiss. The preference for tangible assets with cash flow has been a cornerstone of investment strategy for decades. Over the next five years, sentiment may start to shift. Perceptions about value and investment are evolving rapidly as the information age matures.

In his interview on The Bitcoin Layer, Michael Saylor highlights numerous defects in using property as a long-term store of value. Bitcoin offers an illuminating contrast and provides new perspectives on the world's largest asset class.

Defect 1: Maintenance, repairs and insurance

As physical structures, buildings are exposed to damage from extreme weather and natural disasters, as well as deliberate human-made attacks. It's common to set aside 1-3% of a property's value annually for routine maintenance and repairs. As soon as a building project is completed, the clock starts ticking on its finite lifespan. Typically the structure and services of a building require less frequent maintenance than the facade and interior fixtures and fittings, but they still must be accounted for in a long-term strategy. Maintenance and repairs are inevitable operational costs of owning investment property. Insurance costs are typically only a fraction of a percentage of a property's value, but still need to be considered. More valuable buildings have higher maintenance and insurance costs. Partly due to the increased frequency of extreme weather events, insurance premiums are on the rise.

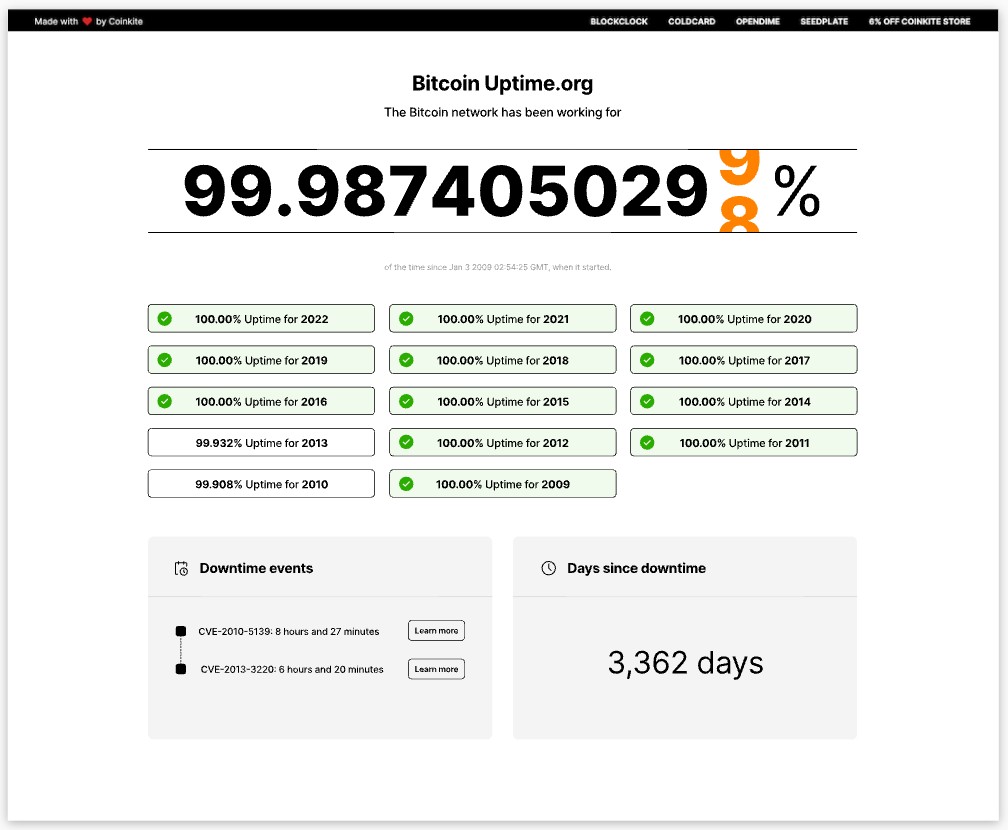

As a digital asset, Bitcoin doesn't need maintenance or insurance in the way that tangible assets do. Its decentralised network has shown remarkable resilience, with over 99.9% uptime. Since its launch almost 15 years ago, seven network effects have contributed to its robust utility and perceived value. That said, holding Bitcoin can have some operational costs and considerations. For example, collaborative custody solutions like Unchained can help Bitcoin users to protect their assets, but come with annual membership costs. It's worth considering that these costs are fixed, regardless of the number of Bitcoin you have. If you're more confident, you can also take custody of large sums by using signing devices and software, which cost less than $100 to set up.

Defect 2: Property taxes

Property taxes on real estate vary by jurisdiction, but they're often a material consideration. In the USA, city or state taxes on property are charged on a recurring annual basis. State taxes range from a fraction of 1% to 2.5%, a considerable factor over the medium-long term. In the UK, a one-time Stamp Duty Land Tax (SDLT) is due on the majority of property purchases. The rate ranges from 2% to 14% of the purchase price, depending on particulars like the use class and the value of the property.

When taxes on property increase due to government policies or political considerations, investors have limited flexibility. In the UK, a controversial tax change known as Section 24 came into full effect in April 2020. The policy restricted tax relief on buy-to-let mortgages. Individual landlords have since been taxed on their turnover, where conventionally taxes are only due on profits. For some landlords, selling up and leaving the market was a rational option. For others, transferring their property into a limited company structure was enough to stay profitable.

As an intangible digital asset, Bitcoin isn't anchored in the same way that real estate is to a particular jurisdiction. It doesn't exist in a city, a state, or a country, and there are no property taxes in cyberspace. Bitcoin can interface with the most accommodating policies and politics in the most attractive jurisdictions. The use case for a digital asset like Bitcoin may still seem very speculative, with a dominant narrative on acquiring wealth. In future, a more defensive narrative may be more fitting. All individuals and organisations have access to a straightforward safe haven for their wealth in Bitcoin.

Defect 3: Localised demand

With its fixed location, real estate can only perform as an investment if there is local demand. International investors target locations where ongoing, strong demand is assumed. Ultimately, it's always exposed to unexpected disruption. Economic downturns, changes in regulations or policies, oversupply, and shifts in population dynamics or job markets can all have an impact. In the UK, political uncertainty around Brexit led to a slowdown in prime central London property. In the USA, areas like North Dakota experienced a real estate boom thanks to the shale oil industry. As oil prices fluctuated, and viability came into question, real estate investors were severely impacted. In recent years, political unrest has softened the appeal of real estate in Hong Kong. Investor sentiment can shift, even in markets that are coveted for long periods.

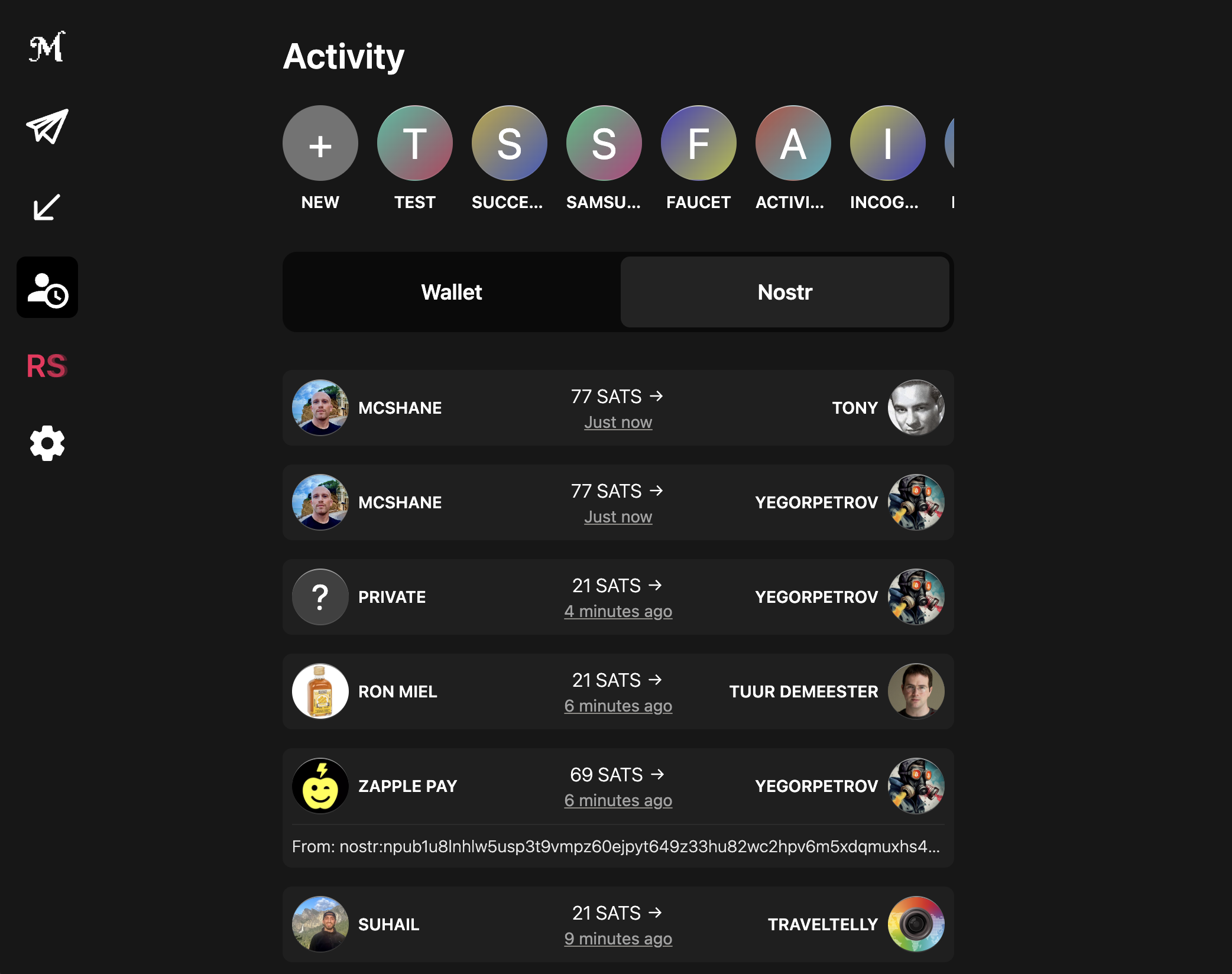

In contrast to the locality of real estate, demand for Bitcoin as a digital asset is global and universal. It's possible to sell or lend Bitcoin at any time across a wide variety of platforms. Centralised and custodial or peer-to-peer and self-custodial options are always available. The value of Bitcoin is not impacted by local events or policies. Supply and demand are diversified across all jurisdictions globally. When compared to other asset classes, its markets are uniquely open and free.

Defect 4: Fixed frequency

Buildings are usually rented to tenants with fixed terms. In the UK, Assured Shorthold Tenancies (ASTs) are the most common form of residential lease. Typically these have a fixed term of 6 or 12 months, but can continue on a month-to-month basis after this period. Commercial leases tend to have longer terms between 5 and 15 years, often with break clauses and rent reviews.

Platform businesses like Airbnb and WeWork have leveraged technology to reduce the minimum duration for renting space. In 2023, it's convenient to rent an apartment for a couple of nights, or a desk by the day. More flexible leasing can increase yields for property investors compared to traditional models. However, operational complexity increases, and fluctuations in demand become more of a risk. WeWork's valuation recently collapsed.

As a digital asset, Bitcoin is highly flexibile compared to investment property. Virtually any frequency is possible when lending it or using it as collateral. Liquidity pools on layer 2 protocols such as the lightning network will be interesting markets to watch. Using digital property at higher frequencies is more feasible than physical property, despite potential technical complexities and risks.

Defect 5: Limited divisibility

Clever design can improve the flexibility and adaptability of buildings. Depending on use class, design can increase how effectively space is occupied. For example, operable partitions can subdivide a commercial space into private offices and open-plan areas for hot desking. As occupancy trends change, space can be further subdivided or recombined. Rather than leasing an entire floor of a building to a single occupant, tenancies can be more granular. Office space is perhaps the most adaptable, but the same principles aren't applicable to a hotel. If hotel suites become under-occupied, they can't be subdivided into multiple standard rooms.

In contrast, Bitcoin's digital nature allows for an unmatched level of divisibility and adaptability. Subdividing and grouping Bitcoin at virtually any scale and any frequency is easy. The same satoshi (0.00000001 BTC) can form the collateral for a large loan one minute and then be sent in a micropayment the next.

Defect 6: Development permission

One of the considerations for property investors is the potential to develop their assets over time. In the game of Monopoly, players move from owning a plot to building houses and hotels. Acquiring adjacent plots and developing them to maximise rents is the only way to stay in the game. In a similar fashion, real urban property portfolios are appraised for their developmental potential.

Picture a light industrial building in a fringe location of a city. Its current use class might be worth a particular rate per square metre. Changing its use to residential apartments would increase this rate. Planning permission to erect a taller building in its place would see its valuation soar. The essence of real estate lies not just in its current use, but in its future development potential. In Monopoly, development is as simple as paying the bank for the house or hotel. In the real world, it's not quite so simple. Property development is subject to planning permission, local building regulations, policies, and politics. The limitations of architecture and construction are always a constraint.

While real estate development is bound by the constraints of jurisdictional approvals, codes and regulations, Bitcoin develops in a borderless and decentralised environment. Cyberspace isn't shackled by physical constraints or bureaucratic red tape. Bitcoin thrives in a dynamic, permissionless development ecosystem. Upgrades are driven by global consensus, unhindered by geographical or jurisdictional boundaries.

"Bitcoin is just beginning to come into its prime. Every time a new lightning wallet is shipped, Bitcoin is upgraded. Every time a new layer three app is created, Bitcoin is upgraded. Every time a new miner comes online, Bitcoin is upgraded. Every time a new regulatory guideline is laid out, Bitcoin is upgraded. So Bitcoin is continuing to improve as property. Real estate is continuing to decay as property."

Michael Saylor, 2022 The Bitcoin Layer

Defect 7: Limited privacy

With property, achieving a sense of physical privacy for occupants relies on design and the neighbouring area. Physical barriers like gates, fences and walls separate urban properties from the public realm. Valuable real estate is increasingly reliant on CCTV systems and private security contracts. In terms of ownership, offshore legal structures can add an extra layer of privacy for investors. These methods can have vulnerabilities. For example, they can be affected by regulatory changes and data leaks, like what happened with the Panama Papers.

No matter what the legal structure or physical context is, property is visible and can be threatened by criminals, governments, or corporations with conflicting interests. As a trophy asset, real estate can attract admiration but also incite jealousy and resentment. As political instability and wealth inequality grow, an investment property could quickly change from being an asset to a liability.

Bitcoin introduces a new paradigm when it comes to the privacy and security of assets. Although the Bitcoin network is based on pseudonymity instead of anonymity, it offers a unique form of privacy that sets it apart from any other form of property. Real estate is always connected to the identity of individuals or organisations through land registries and other centralised records. In contrast, possession of Bitcoin is not inherently connected to the owner’s personal details. This separation from identity provides a degree of privacy that's unachievable with traditional assets (perhaps aside from physical cash). Potential aggressors are less likely to ascertain how much wealth someone possesses in Bitcoin, rendering force or coercion less feasible. This shift in the visibility of wealth alters the dynamics of protection and theft. As more wealth flows into Bitcoin, incentives between individuals and organisations will be more centred on mutually beneficial exchange.

Defect 8: Slow, expensive transactions

Selling property involves costs and time scales that significantly impact returns on investment. In the UK, estate agent fees for residential real estate typically range between 0.75% and 3.5% of the final sale price. There are also conveyancing solicitor fees, which vary depending on the property. Selling a leasehold property with a mortgage usually has higher legal fees than selling a freehold property without a mortgage. Part of the conveyancer's scope is to deal with the relevant land registry.

In England and Wales, HM Land Registry is the centralised ledger for real estate. They provide property owners with a title deed that's guaranteed by the government. They can't, however, offer any guarantees on processing times. The costs of agents and solicitors, along with the financial impact of void periods, significantly reduce the net returns from selling a property. With so many variables involved, real estate transactions are often slower and more expensive than initially anticipated.

In stark contrast, exchanging Bitcoin is a streamlined and cost-effective process. Fees when trading Bitcoin are often negligible, and final settlement typically takes 1 hour. Network transaction fees are analogous to the conveyancing fees involved in property deals. By paying a transaction fee, a user can update Bitcoin's distributed ledger, transferring possession of satoshis to another peer in the network. Fees are contingent upon a transaction's complexity and the current network congestion, but they remain remarkably low, especially for higher-value transactions.

A notable example occurred in April 2020 when a massive transaction of 161,500 BTC - worth $1+ billion at the time – was executed for a mere 10,019 sats, equivalent to just $0.66. Exchange fees when buying or selling Bitcoin are perhaps the closest equivalent to agent fees. These fees are typically lower when using centralised exchanges like Kraken, and higher when using peer-to-peer options like Bisq. A 1 BTC trade on Kraken could be executed for a combined fee as low as 0.42%. Completing a 1 BTC trade on Bisq would involve on-chain transaction fees, and a combined trading fee of 1.3%.

Defect 9: Limited economic density

With real estate, economic value is tied to the physical size of land or buildings in relation to local demand. The economic density of investment property is heavily influenced by its location. Real estate in a global city like London or New York commands a far higher value than a comparable property in a less prominent city. As a unique residential skyscraper in a global city, 432 Park Avenue in New York symbolises immense economic density. However, the value of the site is ultimately capped by physical constraints. There's also a ceiling on demand for space in the building relative to the immediate context. Residence 36 A is on the market for ~$17 million (£36,630 per square meter), realistically the number of potential buyers is rather limited.

As an asset in cyberspace, Bitcoin is liberated from the constraints of both physical space and localised demand. It embodies 'infinite economic density', where value is completely dislocated from the constraints of the material world. The notion of securing Bitcoin with equivalent economic value to an apartment at 432 Park Avenue illustrates the point. A device to do so easily fits into the palm of your hand. It could secure value equivalent to an apartment, the whole skyscraper, or the whole neighbourhood.

Defect 10: Unlimited total supply

The total supply of real estate in any market is dynamic and continually evolving, influenced by demand and regulatory frameworks. As cities grow and urban populations increase, there's a clear incentive to use desirable land more efficiently. Denser neighbourhoods and taller buildings become profitable development opportunities. In locations with extreme pressures on available supply, engineering projects like land reclamation can become viable.

The elasticity of total supply is a defining characteristic of real estate as an asset class. In densely populated areas, where development is tightly regulated or physically limited, the value of land can skyrocket. When a strong enough market incentive builds up, assumed constraints can become subject to change. As well as economic pressure, shifting political landscapes and societal needs also have an influence. Although new supply is typically very low compared to the existing building stock, total supply can always expand or contract in response to external conditions.

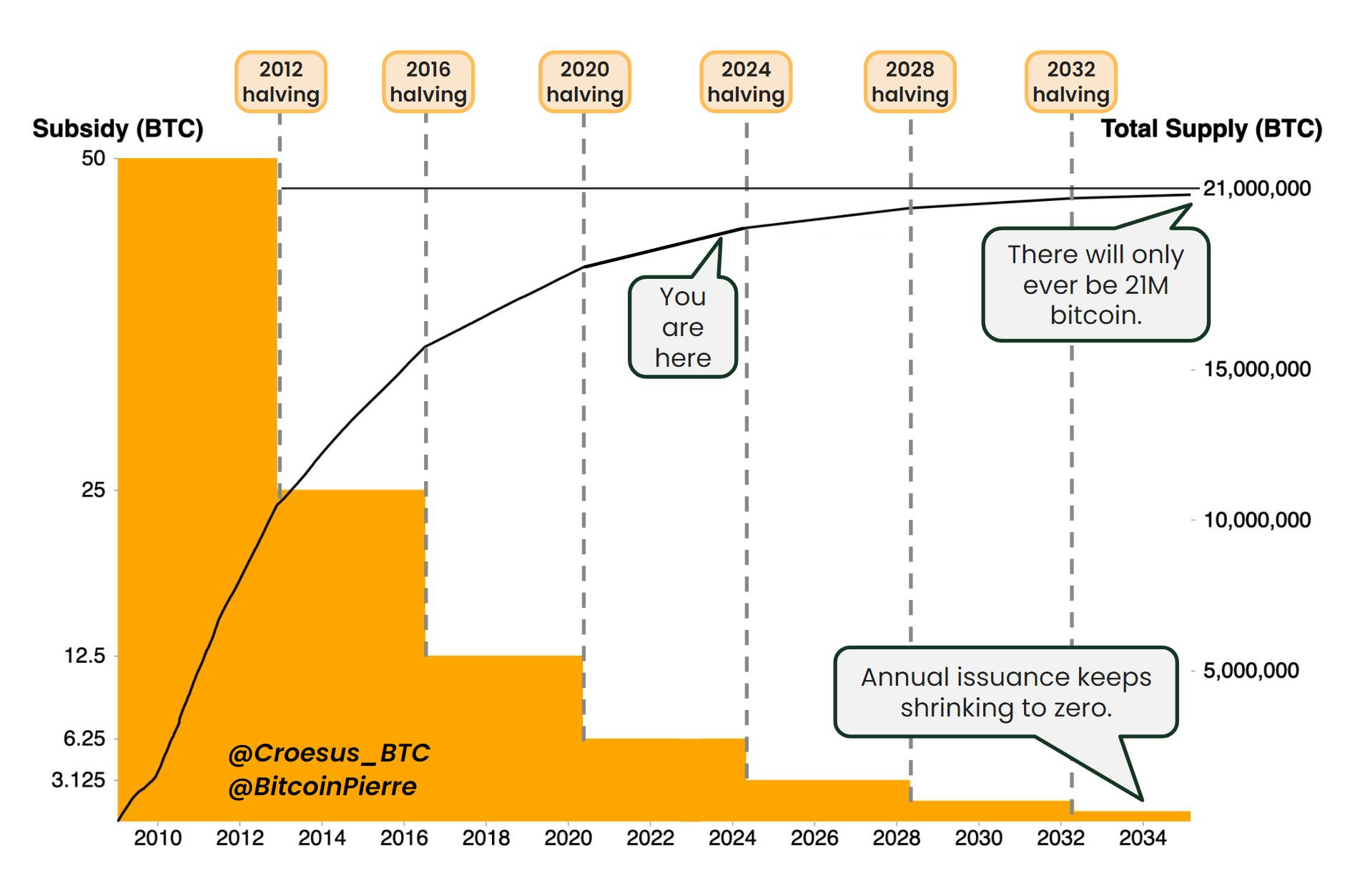

With real estate, scarcity has always been a relative concept, as total supply can respond to demand. In contrast, Bitcoin's total supply cannot be influenced by market demands or political shifts. This inelasticity is a novel and radical concept to grasp. No matter how much demand for Bitcoin grows, the network will credibly enforce a fixed total supply on a decentralised basis. Only 21 million bitcoin will ever exist.

As this concept becomes more widely understood, and as Bitcoin becomes more universally desirable, its continued adoption will likely lead to 'absolute scarcity'. There's never been an asset class with the potential for unlimited demand and a strictly finite supply. The available supply of Bitcoin will be much lower that 21 million in the future, as more coins are inevitably hoarded, lost or destroyed. The only way for the free market to respond to increasing, and potentially absolute scarcity, is with much higher prices.

How does real estate get demonetised?

A reversal of the monetisation trend in real estate begins with investors and speculators recognising the limitations and defects of investment property. Forty years of declining interest rates have been hugely beneficial for property portfolios. If we're experiencing a sea change in the investment environment, and the easy times and easy money are over, drawbacks might start to become more apparent.

Liquidity issues, inflating finance and maintenance costs, rising taxes and the burden of regulatory constraints will all be harder to ignore. The shortcomings of investment property will be further highlighted as more comparisons are drawn with the attributes of Bitcoin. As a digital asset, it shows promise as the perfect store of value for individuals and organisations alike.

"you don't understand the defects in your property until you see perfect synthetic property or digital property, just like you don't understand the defects in your currency until you see perfect currency. If you don't understand Bitcoin, you don't know what's wrong with gold. And you don't understand what's wrong with fiat currency really, until you understand what's right about Bitcoin. And I think the same is true with property holders, they don't understand what's wrong with their investment until they understand what perfection looks like."

Michael Saylor, 2022 The Bitcoin Layer

As Bitcoin becomes more widely understood, and its perceived risks decrease over time, it will only become more attractive. In recent years, risks and critiques of Bitcoin have largely been debated on podcasts and social media. More mainstream economists, and legacy media sources haven't held back with their scepticism. It's been difficult, if not impossible, for serious investors to make an allocation. There hasn't been an attractive integration for Bitcoin into traditional finance rails, and mainstream consensus has been to avoid it regardless. Polished research studies by long standing and credible firms have now picked up the baton to debunk the most common criticisms and misconceptions. All the while, a spot Bitcoin ETF is expected to be approved in the United States in the coming months.

Investment Property vs Bitcoin as a store of value

| Factor | Investment Property | Bitcoin |

|---|---|---|

| 1. Maintenance, repairs and insurance costs | Significant | Negligible |

| 2. Taxes | Property sale tax, recurring property tax, capital gains tax | Capital gains tax |

| 3. Demand | Local, Limited | Global, Unlimited |

| 4. Frequency | Fixed | Flexible |

| 5. Divisibility | Limited | Unmatched |

| 6. Development | Permissioned | Permissionless |

| 7. Privacy | Possible, expensive | Possible, technical |

| 8. Transactions | Relatively expensive, slow | Relatively cheap, fast |

| 9. Economic Density | Limited | Unlimited |

| 10. Total Supply | Elastic, unlimited | Inelastic, limited |

Bitcoin is being taken more seriously, but will money really flow into the digital asset from real estate? For wealthy investors who are diversified across asset classes, investment property could be one of their least liquid holdings. Rebalancing a portfolio by selling real estate in order to make an allocation to Bitcoin would be a radical and unlikely step. A more likely first move would be directing free cash flows to Bitcoin instead of a new property deal. For smaller investors however, selling an investment property that's underperforming and using some of the proceeds to buy Bitcoin is a realistic prospect. The new ETF is the most likely vehicle for new demand. Collaborative custody solutions which are unique to Bitcoin are also likely to grow in appeal.

Over the next decade, some early adopters of Bitcoin may wish to purchase real estate with their new found wealth, but this will likely be a primary residence or the premises for a business rather than an investment property. Future capital flows from Bitcoin into real estate would be seeking utility rather contributing to the current monetisation. As Bitcoin's outperformance as a store of value becomes clearer, the monetary premium flowing out of real estate will be one way traffic. Whilst this is bad news for amateur property investors who are late to the trend, the demonetisation of real estate as a store of value will have several societal benefits.

Benefits of demonetising real estate.

If property prices realign with utility values, affordability for individuals and organisations who use buildings will improve. This would be a welcome change for young people in particular, for whom homeownership in most desirable locations has become completely unrealistic. In contrast to a political proposal, the market incentive for store of value to flow from real estate into Bitcoin could be a genuine help in alleviating the housing crises in cities around the world.

Secondly, demonetisation would lead to a reduction in speculative real estate developments, which often prioritise short term profit over genuine long term placemaking. With less emphasis on real estate as a store of wealth, developments could become more responsive to the needs of real economies and communities. Bringing utility and beauty back into full focus would be a boost for thoughtful architects and urbanists.

Finally, the flow of monetary premium out of real estate will benefit the green agenda. Buy to leave properties that are left vacant as stores of value are one of the most egregious examples of malinvestment and inefficiency in the built environment. The construction industry is consuming scarce resources, producing emissions and polluting in the development of new buildings as existing buildings lie empty or underutilised. As the opportunity cost of holding property as a store of value increases, a substantial volume of new supply will come to market without as much reliance on developing new buildings.

Bitcoin highlights several defects in using investment property as a store of value. It will be interesting to watch the monetisation of Bitcoin and the demonetisation of real estate play out in the future.

References

.png)

.png)