Bitcoin Talents interview with Salim Suleiman

Introduction

One of the assignments in the Bitcoin Talents program offers the opportunity for participants to conduct an interview with someone in their professional network. The idea of the interview is to revisit parts of the curriculum, explore Bitcoin narratives and sound out any particular opinions and experiences of the interviewee.

When I took part in the first cohort of the program, I reached out to Rahul Shah, a London-based property expert. I interviewed him about his career and his more recent experiences with Bitcoin. As a mentor in the second cohort, I had the opportunity to experience the assignment from the other side of the table. Salim, an economist and participant in the second cohort, reached out to me to ask some of the questions at the forefront of his mind. I shared my understanding of some of the key narratives and did my best to point out the most relevant references.

Check out the transcript below, with the addition of some visual references.

Questions

- Is Bitcoin backed by anything?

- What does it mean to have a bitcoin?

- Is there any similarity between bitcoin mining and gold mining?

- Bitcoin is like a language, in that it isn’t governed by democracy, it’s more like anarchy – without rulers, but not without rules – can you elaborate on this?

- Bitcoin versus Ethereum - noticing the innovative features of the latter, do you think the former could be dethroned from the total capitalisation of 48% of the crypto market?

Is Bitcoin backed by anything?

Salim: Let's get started! I have five questions, and I’ll be happy if you can give me your insights and what comes to mind. So, with the first question, this is inspired by a challenge someone pointed out to me while I was trying to advocate for Bitcoin. He said “Bitcoin is not backed by anything” amongst some other statements, which were mostly critical. That's why I really want to redirect that question to you. Is this true that Bitcoin is not backed by anything? Perhaps you have a comment?

Ian: I think this one is a really interesting question, Salim. So then, what’s the frame of reference for this? I think people are conditioned to living in a world of fiat currency, and that fiat currency has the backing of the government. They'll guarantee that you can pay taxes in that currency. They expect to have some revenue coming in from their citizens denominated in that currency.

But when we're evaluating Bitcoin, there are no governments or taxes directly involved. In a recent report from Fidelity, a big asset manager in the United States, they said that bitcoin is best understood as a monetary good and that the thesis for investing in it today would be that it's going to be the store of value asset in a more digital world. When we're considering monetary goods, government backing is a relatively recent phenomenon. Ultimately it's a case of what does the free market determine to be a successful monetary good, one which is desirable, one which is going to be the first preference for people in different countries or in different markets.

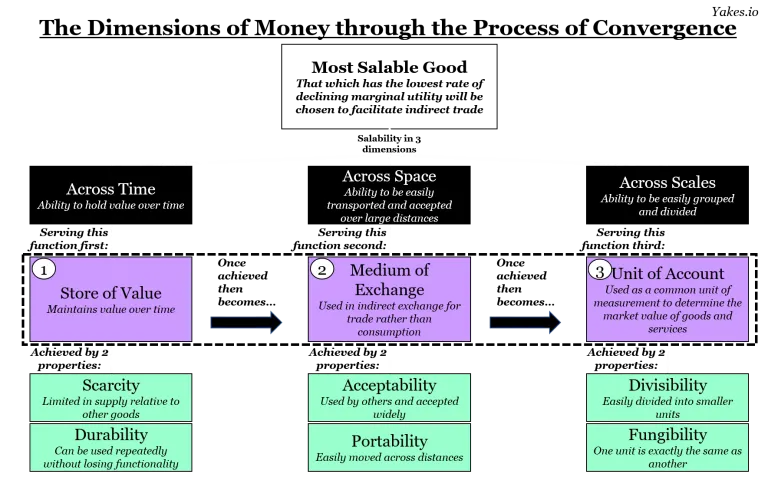

So, when I think of framing the question ‘What is Bitcoin backed by?’, perhaps the most useful discussion would be its properties as a monetary good. There are some great commentators on monetary properties, whether they focus on the history of money, introduce Bitcoin, or explore why gold was selected by the free market as money for so long. They arrive at similar common properties, ones which we get into on the Bitcoin Talents Program. Scarcity, durability, these are properties that help with the function of store value. Acceptability, portability, these are properties associated with medium of exchange and that function. Also, divisibility and fungibility, which are maybe more closely mapped to the unit of account function. So, these properties are what are in my mind when I think of what is ‘backing’ a form of money. Other people in a free market will recognize those properties, and if they understand them, they will likely consider bitcoin as having some success as a monetary good.

I think my favourite thought leader on this topic is a guy called Eric Yakes, who wrote the book, The Seventh Property; which is all about Bitcoin and the monetary revolution that’s going on. He says that the extra property that bitcoin has, is this idea of immutability. The architecture of the Bitcoin network, the game theory, the incentives, they all create a money system in which the production and storage of money are decentralised.

So summarising, I think a good place to start is with the properties of money and comparing people's preference for one monetary good or another. It depends on who you ask! Some people say, of course, money should be subject to free market competition. Others would say, no, no, the system of money must be created by the government or the state, they will back it, and they can be trusted to make sure that everything's run in a nice way. So it depends on who you ask.

Salim: OK, understood. Maybe we can move to the next questions, right?

Ian: Of course.

What does it mean to have a bitcoin?

Salim: OK, what does it mean to have a bitcoin?

Ian: Great question, this can get really interesting! You know there's this saying which is one of the main principles of self-custody, it's “not your keys, not your coins”. This has become a kind of mantra for Bitcoin users. But in a way, having a bitcoin is just like keeping a secret, because knowledge of the private key and ownership of the bitcoin is very similar. Information itself, in the form of the private key, becomes literally valuable with bitcoin. Because with that private key, you can sign a transaction and you can move bitcoin to an address associated with a different private key. So it's quite abstract, but to have bitcoin is to keep a secret. If you share your private key with someone else, they have access to that bitcoin as well, they can also sign a transaction. In order to spend bitcoin, having knowledge of the private key is necessary, and if that knowledge is yours only, then you have ownership.

A private key is a random 256-bit number, here's an example in hexadecimal format:

The total number of 256-bit numbers, hence the total number of possible private keys is equal to 2256. In decimal this is approximately 1077 , the visible universe is estimated to contain 1080 atoms.

Is there any similarity between bitcoin mining and gold mining?

Salim: OK, is there any similarity between bitcoin mining and gold mining? Because both Bitcoin and gold are both something we mine to get, right? How can you compare the process of mining bitcoin and mining gold?

Ian: To be honest I think mining can be an analogy which causes a lot of confusion with Bitcoin. Just like the idea of a wallet, what is a Bitcoin wallet? Often people think that bitcoin is stored in the wallet some how, in the same way that cash is stored inside a wallet in their pocket in the physical sense. But the software for a Bitcoin wallet could be more comparable to a key ring, after all the wallet interacts with your private keys. A private key allows you to sign a transaction in a similar way that a key on a key ring allows you to open a door. So with mining, I think it's similar in the sense that the analogy doesn't help, I’ll try and expand.

With gold miners, creating new supply is what they’re in the business of doing. They go out there, with the element of prospecting or looking for the new supply, maybe doing some test mining, and hopefully come across a discovery. Gold mining is fundamentally about the production of the new supply of gold. After it’s mined, that gold is refined and it becomes a coin or a bar and it is kept in a vault or it might become a piece of jewellery.

With Bitcoin mining, the process does release new coins, in the form of the block subsidy, but the miners are also confirming transactions and they're securing the network. Bitcoin as a system is a distributed network. Miners are a key part of that alongside nodes. I think that's where the analogy can really break down. Gold is like a token that you can hold in your hand, physical in nature. For example, if I hold a coin and I pass it to you, there's no record keeping necessary for that transaction to take place, and the gold miners aren't involved in that stage. Whereas with Bitcoin, it’s a ledger system. If I have bitcoin associated with one of my receiving addresses, and I send it to you by signing a transaction and broadcasting that to the network. That transaction must reach a node on the network and include a fee to be ‘mined’ as part of a valid block and be added to the blockchain. So, you see that ‘miners’ are involved in new supply of bitcoin, but they're also involved in transactions.

One of the most interesting analogies I've heard for Bitcoin miners is the idea of a timestamping server for the ledger. There's a great resource on this by a guy called Gigi; he talks about the time stamping problem with ledgers, and he talks really specifically about how the proof of work consensus method with Bitcoin solves that problem.

In this interview with Preston Pysh, Gigi expands upon his article Bitcoin is time

So, Bitcoin mining and gold mining are very different. Gold mining is a lot easier to understand! One of the most common things people people point to with Bitcoin mining is energy use, and they’re probably critical about it. Mining consumes energy, and if that's from hydrocarbons, it could create emissions, and it could pollute the environment, and there are negative effects… But there's no reason why Bitcoin mining can't use green sources of energy or renewable energy which has very low or no emissions. Also as a digital network, it doesn't have the problems of that come with the physicality of gold. Think of gold and the mining process. The the labor conditions, human right issues, the pollution, the corruption involved, there's a dark underside to the gold mining industry. There’s more scope to be critical than with Bitcoin mining!

Bitcoin Governance

Salim: We can move to the next question, which is about governance in Bitcoin. So, Bitcoin is like a language which isn’t governed by democracy. Everyone's language is not governed by any government system. Still, anarchy - something without central authority, without rulers, but not without rules. How can I elaborate this to a common man to understand this concept?

Ian: Yes, I think in a system of democracy, there's a degree of trust, which is put in certain figures, and there's a reliance on a democratic process of voting, which can be challenged in terms of how effective that is, or how well it represents each individual and their preferences. By no means am I an expert on politics and how the system of democracy has evolved, how it can be corrupted, or how it succeeds or fails. But I think one of the most important things to take away from it is that there is a degree of hierarchy in the system. There are citizens who vote, but there are people that are trusted in positions of power and authority, which have to be trusted to respond to the votes or the interests of the people. In Bitcoin world, everyone has the same degree of control, it's less of a hierarchy. Each peer in the network abides by the same rules, and the rules of the game state that there is a fixed limit of 21 million bitcoin. And if you play by those rules, and you want to interface with the Bitcoin network, you can do so in a voluntary way. Also, if you want to change the rules, you're free to do so. All of the code is open source. You can create your own version of Bitcoin. It doesn't necessarily mean that anyone will follow you, but you're free to change the rules. The system is one of consensus across a network of peers who all agree that they will use the system as it is. So there are rules, like the rules of the game. But they aren't enforced by a ruler. They're enforced by a crowd consensus of individual peers. It's very different to democratic system. I hope that expands on it. I'm not an expert on politics, but that would be my kind of comparison.

So, no matter how much you own - you could own a large sum of Bitcoin - that doesn't give you any more control of the network than another peer who has a very small amount of Bitcoin. But in a democratic system, someone with a lot of money can approach an individual who’s in a trusted position of responsibility, whether through means of lobbying, or in a more corrupt system (or a more explicitly corrupt system) through bribes, they can pay their way and they can try and game the system to change it in their interest, even if there's a conflict of interest with the citizens. This kind of thing can't happen in Bitcoin governance, or at least not in this direct way.

Maybe there will be challenges for Bitcoin governance in future when people want to propose changes or propose further forks. I think the most helpful example to study when looking at Bitcoin governance is the block size war, and how that led to a hard fork. The market decided which fork was going to succeed and which would fail, and maybe some of the people that were making the proposals or changing the code were surprised by the outcome of the market and what the market decided.

Salim: Very interesting, let’s try and stick to the time and move on to the next question!

Bitcoin vs Ethereum

Salim: I will be happy if we move to the next question which is actually very important to me, the battle between Bitcoin and Ethereum. So, noticing some of the innovative features of Ethereum, do you think the Bitcoin could be dethroned from the capitalization of 48% of the total crypto market? If yes, then how, else why?

Ethereum is a Blockchain which really has a lot of features. Not only about money, but about other aspects of Blockchain systems, and it’s progressing. How can we discuss this question?

Ian: I think Bitcoin and non-Bitcoin projects or Blockchains have to be evaluated with a different perspective. So, if Bitcoin is understood as a new kind of monetary good, a new digital asset or a store of value asset in the digital world, that's a different proposition to Ethereum, which has the utility of the smart contracts and the extra features that you mentioned. I think you have one framework for Bitcoin and you have another framework for altcoins, including Ethereum, or other alternative projects or Blockchains. As best as you can, the saying is “you have to compare apples with apples, rather than apples with oranges”.

How do the two differ? Well, the first is the consensus mechanism. Bitcoin has a proof of work consensus mechanism. Ethereum, for over a year now, has been on a proof of stake consensus mechanism. There's a great presentation by an on-chain analyst call Checkmate He dug into the details of the merge for Ethereum when it transitioned to proof of stake. I believe it was in August last year (2022). He really gets into some of the challenges of the proof of stake system of consensus compared to proof of work.

This leads to the idea of the dominance percentage, or the capitalization of Bitcoin as a percentage of the total crypto market, because really, Bitcoin can only be compared with other proof of work consensus projects. This could be Dogecoin, Litecoin and it could also be Ethereum classic which is still proof of work. There's another reference, it's a neat website, which shows how many confirmations are equivalent to six Bitcoin confirmations, it's called howmanyconfs.com. It shows that other Proof of Work Projects are many multiples slower in terms of equal security or equal assurance in the number of confirmations. So Dogecoin or Litecoin maybe 20 times slower than Bitcoin.

I think another other factor is the distribution of Bitcoin, the distribution of the supply, are there some early whales who own a disproportionate amount of the supply? And how is this, a good or a bad thing? But the distribution of bitcoins compared to Ethereum is more provably fair. Not very many people know this, but Ethereum had a very high percentage pre-mine. Before it was launched a handful of people, less than 10 people or individuals had around 70% of the supply. It was highly concentrated. The element of a pre-mine is another factor where you can't really compare Bitcoin as a project against Ethereum. So, there are two frameworks and necessary one for Bitcoin and one for altcoins. Also, just how many features can one project have? With Ethereum it looks quite confusing as to what it's trying to be still or that the narrative may be shifting.

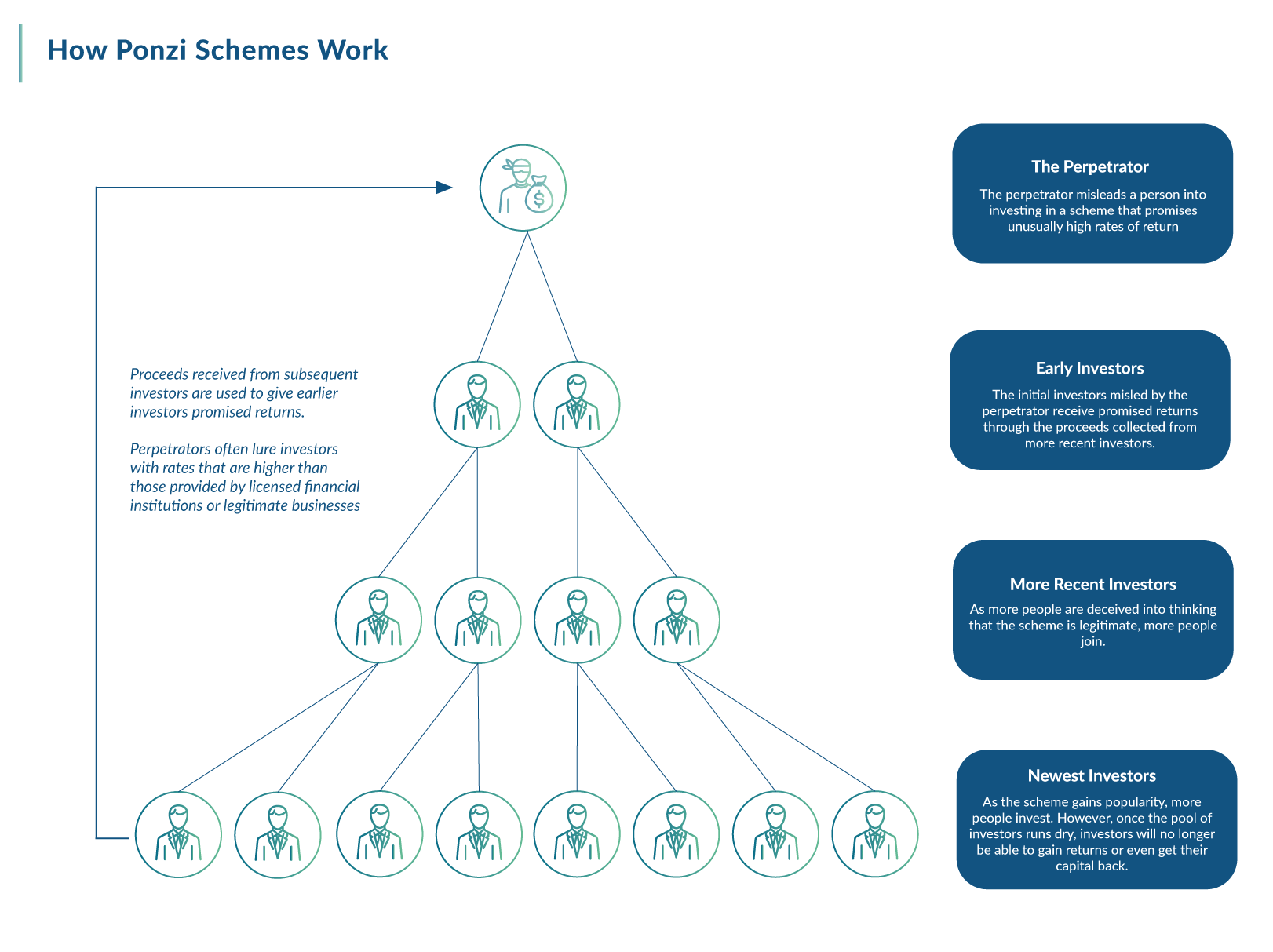

Salim: Thank you very much for the comparison. Regarding that question that a friend of mine asked earlier, relating to the first question. He mentioned one thing that happens to be a common misconception, especially in Nigeria, associated with saying Bitcoin is not backed by anything. What if - as, you know, with pyramid marketing or a Ponzi scheme - someday after people invest their money in Bitcoin, they lose it? Or what if Bitcoin doesn’t really become well know, because even Satoshi Nakamoto is a pseudonym for something unknown. This is actually a misconception that is widely circulating in Nigeria. That's why I think the reason other person questioned me about it, at the time.

Ian: Yes, that makes sense.

Salim: So with the rules and algorithms with Bitcoin, these would not render the system to be something where we wake up one day and see that there is no Bitcoin anymore? Would they deter it; will they prevent that from happening?

Ian: Well, I think with the Ponzi scheme comparison, there have been some great articles which explore this criticism in more depth. One of the first things that's different with Bitcoin and a Ponzi scheme in the traditional sense is that, a Ponzi scheme is offering some kind of investment reward or some kind of return, with Bitcoin there is no return and there is no yield. When you exchange from your fiat currency to Bitcoin, you're making a speculation. If you're using it to store value, you're making a speculation that the properties of Bitcoin will ensure that it is a more successful store of value in the longer term and the fiat currency. Or you may exchange from fiat currency to Bitcoin, to use it for a payment, a payment which can't be censored, one that can't be controlled. You may also earn Bitcoin for a good or a service which you provided to the market.

So a Ponzi scheme is a fraudulent scheme which involves investors and a bogus kind of enterprise, and that enterprise isn't profitable. The returns which are going to the early investors are coming from the new investors that are joining the system. It's not comparable to Bitcoin. With new entrants, sure some of them are some speculators, they think that due to Bitcoin’s scarcity, or perceived scarcity and the limit of 21 million coins, that it will appreciate in value in the future. But they don’t expect any investment return.

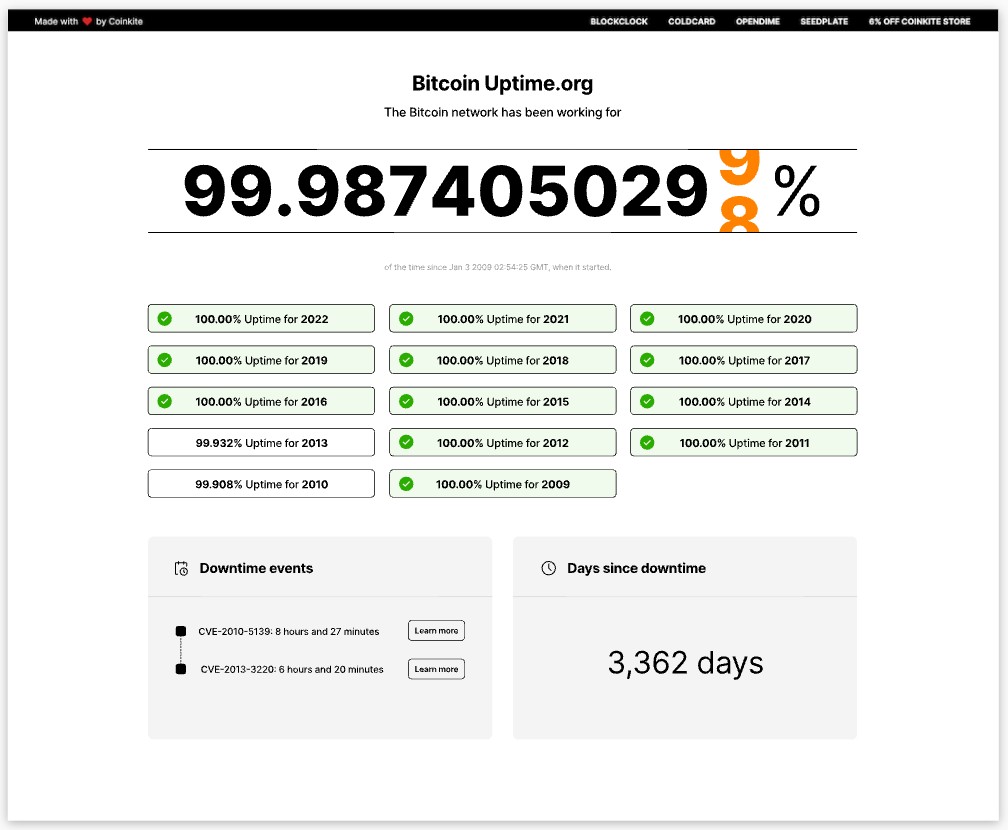

As we approach the 15th birthday of Bitcoin, it’s had very high uptime, over 99.9%. The more years that the system continues without any problems, the more people will perceive it, for example, like the internet. The internet has a perception that it will continue indefinitely into the future, and everybody is incentivised to maintain the internet as a network which brings great connectivity and convenience to people around the world. Don't forget that Bitcoin users also have the incentive to sustain the network through time. Whether it's running a node to keep a backup of the Blockchain itself or whether it's software developers that own Bitcoin that are incentivised to work on the code. There are many network effects which are overlapping. There’s a great resource by an early advocate of Bitcoin called Trace Mayer, he had an article about the The Seven Network effects of Bitcoin. It looks at the various overlapping incentives of all the players involved and I think these lead most people to have very strong confidence in the future of the project.

Salim: OK, this is something they call the Lindy effect, right?

Ian: Yes, exactly, the Lindy effect, which was popularised by Nassim Taleb. He says “if something's been around for 10 years, it's likely it will exist in another 10 years”. I think that’s applicable to Bitcoin, the longer that it grows, in terms of awareness, in terms of a brand, as Bitcoin is a very powerful global brand, people have heard of it. They might not fully understand how it works or why it has value, but they have mindshare. They have a response when they think of Bitcoin, maybe they have some questions! But as it grows older, it will only become more and more entrenched in terms of more users, more adoption, more clarity around the narratives, the value and the use cases. As someone who uses Bitcoin, I don't lose sleep at night thinking that this project is going to collapse tomorrow. It is not a concern for me, at least.

Salim: Thank you so much for all the insights you shared with me. I really appreciate you, I have nothing to say but to pray for your long and healthy life ahead and good things to happen to you, I really appreciate your kindness for this.

References:

The Dimensions of Money, Eric Yakes:

https://bitcoinmagazine.com/culture/bitcoin-dimensions-of-money