Building wealth in London: from buy-to-let to Bitcoin.

Ian: Today I'm meeting with Rahul Shah, a London based mortgage and property finance expert - we're going to talk through his career and hopefully gain some insight on his approach to building wealth over the last 20 years or so.

Rahul, perhaps you can introduce yourself and what you do day to day?

Rahul: Sure, I've been a mortgage broker in Central London since 2000. From 2000, I've also built up a buy-to-let property portfolio here on an organic basis. Twenty three years on, the world’s quite a different place to what it was.

Ian: How has your career evolved since 2000? I wonder what's changed since then and if anything has stayed the same?

Rahul: To rewind to the late 90s, I'd just finished university, and come to London to find a job. I started working as a trainee accountant - I didn't last very long! After about five months I realised that I wasn't quite cut out for being employed. I remember seeing an advert in a newspaper for a job in the city. I followed it up and it turned out that it was recruiting self-employed financial advisors to become life insurance salesmen.

Ian: I see.

Rahul: I remember doing that for a couple of years from 1998 to 2000. Now at that time, the main ways retail investors would have of saving money or building wealth would be using things like high interest savings accounts, or tax advantaged accounts called TESSAs which were a little bit like ISAs today. Or another way, what I was trying to sell people at that time, which were quite expensive and inflexible life insurance contracts, termed endowments. So these were 25 year contracts where someone would pay into them on a monthly basis with the idea that in 25 years, you'd cash it in and the policy would be tax free. You'd have a lump sum to pay for some future financial goal, or maybe pay off your mortgage. Quite often it would be a way to save for your children's education or university, things like that.

Ian: Can you remember roughly what interest rates were like, say if you just had cash sitting in the bank?

Rahul: I remember the base rate was probably about 8%. So I'm pretty sure you could get cash saving rates of 5% plus.

Ian: So even on your rainy day money, you're earning some kind of return?

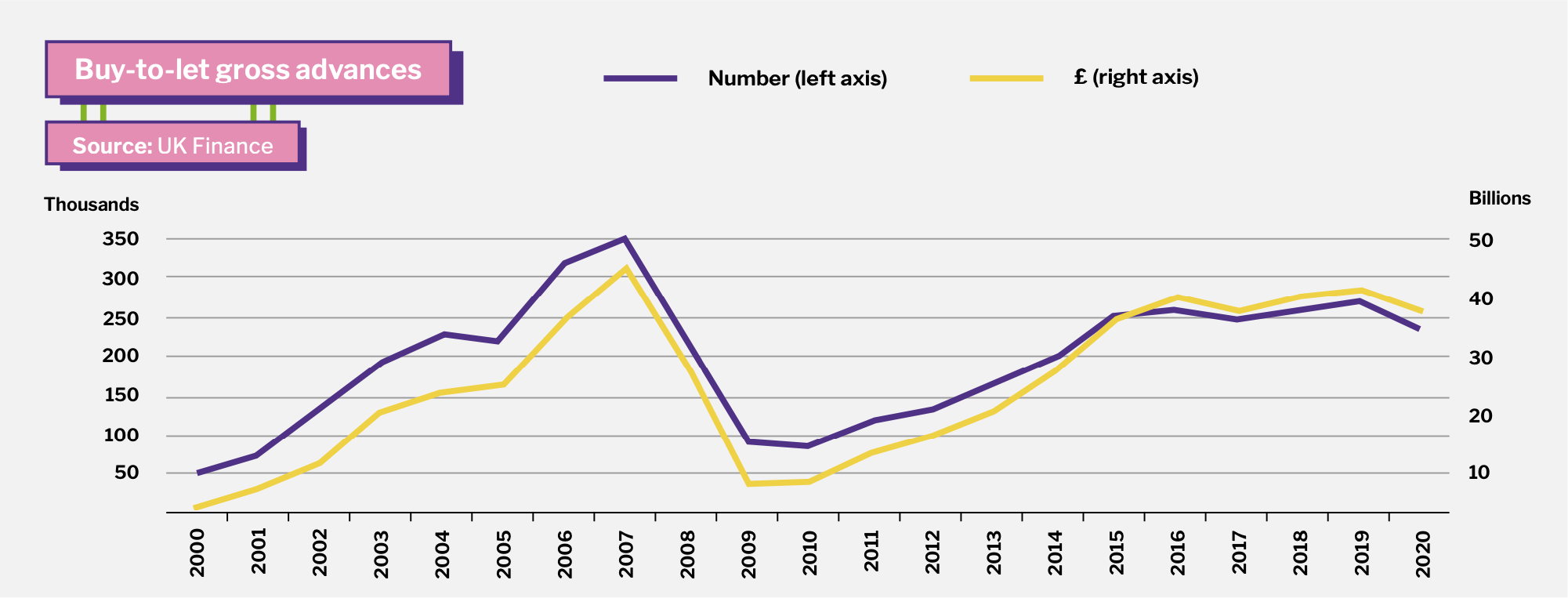

Rahul: You are, but then obviously there was also inflation at the time as well. I can't recall what that was. But there weren't many tools that people could use to save and create wealth or preserve the spending power of money they set aside. It was in 2000 that I changed tack slightly and became a mortgage broker. At the time, it was an advent of sorts for innovations in the mortgage market. There was a lender called Mortgage Express, which was part of Bradford & Bingley Building Society. They became the first UK buy-to-let mortgage lender.

For the first time they allowed individuals to buy property as an investment. Previously, you could only get a mortgage for a property you wanted to live in. You'd be curtailed by your income or your salary. Lenders were typically more conservative back then, and maybe lend you back three times your income. But with the buy-to-let mortgage, it allowed you to buy a property, or multiple properties, based on the rental cash flow. So a lender would typically say "fine, this is what the interest rate and the payment is, we demand that your rental income for that asset is at least 125%, 130%, or 150%, whatever the interest payment is."

Ian: So as a broker, were you selling buy-to-let mortgage products?

Rahul: When I started in 2000, I’d say that 100% of the mortgages I was arranging were for owner occupiers. So they weren't for buy-to-let investors.

Ian: I see, right.

Rahul: For myself, I got into buy-to-let first before going on to arrange quite a lot of these for clients. And that just was by luck, really. I actually ended up investing in several buy-to-let properties whilst I was still in rented accommodation myself, before deciding to buy my own house. My goal was to achieve a level of passive income that was sufficient for me to be able to pay my rent without having to resort to my own income. So that was my first goal, but I was mostly advising and arranging mortgages for owner occupiers.

Ian: Okay, so you were ahead of the curve with buy-to-let?

Rahul: It was really from 2002 onwards that I noticed a lot more demand from other investors in my position. All different kinds of people, but typically it would be professionals with good jobs, that would have surplus income. They wanted somewhere to park that money.

Ian: So middle class people, they've got a good salary, they may own a property already, and they’re taking a further step?

Rahul: Essentially. The first obstacle would be for people to get a deposit together, which at the time was typically 25%. That was a considerable hurdle for many.

Ian: I see.

Rahul: But, suddenly you've got a new asset class emerging. An opportunity where people can buy some real estate, make some positive cash flow, because the rental income coming in is more than the interest they're paying out on the mortgage. They also hope to benefit from capital appreciation in the property too.

Ian: And also the leverage involved as well?

Rahul: The leverage involved as well. So then their return on capital is significantly more. Yeah, absolutely. I mean, let's say you have £25k to invest. And you've got £25k in equities. Say they're paying you a 5% dividend and increasing by 10% per annum, that's fantastic. But all that growth is based on your £25k. If you had a buy-to-let property and you're using that £25k, you're borrowing £75k and investing £100k. If you're achieving similar % returns, there's far greater return on investment because you've got £100k base value.

Ian: So, an attractive new opportunity and you've got a front row seat at that moment in time?

Rahul: Correct. And it was really just that logic, and making sure that I had very low outgoings for a long time, which allowed me to save money and actually have capital to put into further buy-to-let properties.

Ian: So you weren't thinking, I've got this income coming in, I'm now going to go into the stock market or I'm going to explore something else. You thought you've got a winning strategy here, and you wanted to scale that?

Rahul: At the time, my focus was buy-to-let, but alongside that I was still sure to maximise tax wrappers. They had things called PEPs at the time, which also became what we refer to as ISAs. The allowances on these has changed over time, I think currently, you’re allowed to put £20,000 into these. I don't think it was as generous as that previously. But if you buy any stocks and shares within that tax wrapper, it means that all of the dividend income, and all the capital growth is completely tax free. Now, we don't get many kinds of tax advantages. So for me, they were hugely beneficial, and I would always try and max fund whatever I had in those wrappers as well, alongside any investment in buy-to-let.

Okay. I mean, previous to that, the only other kind of investments that had maybe greater tax benefits was the pension. But my argument with the pension is that it's very inflexible, you can't touch it until you're 50 or 55. When you do, you can only access a percentage of it tax free as a lump sum, with the balance of it, you have to buy an annuity, which, again is very inflexible. So there's quite big tax benefits from the pension. But I think there's a lot of flexibility restrictions. For young people, that can be a bit of a turn off. If you're investing in an ISA, and then five years down the line, you want to go travelling for two years, you can easily access that money.

Ian: Yeah, of course.

Rahul: Say you're going to have a wedding too - I think it's quite useful having that flexibility. What people might do is actually just split things between a long term savings horizon, like their pension and the shorter term horizon, which might be an ISA.

Ian: Did your strategy change at all then through the 2000s into the 2010s? Maybe some people thought it was the end of the world in 2008-9 when it came to property. What did the financial crisis look like being on the ground?

Rahul: I tried to ignore what the paper value of the property was. I always saw it as a long term thing. My view was that as long as I can service the interest I can ride through any fluctuations in the market.

Ian: Ok, so you weren't particularly fazed.

Rahul: My strategy right from the start was to buy things that I thought would mitigate my risk. A lot of people would argue that with property, it's all about location. And I definitely agree with that. But sometimes, you hear the argument "Well, a prime location in London is going to benefit from less fluctuation, and maybe better long term capital growth." First, I couldn't afford to buy in Mayfair or prime central London at the time, but even if I could, the yields I would be making would be significantly lower. As a result, I'd be more susceptible to interest rate risk as well.

My view from the outset was to buy in locations that were good value, where I could achieve higher yields. They tended to be in the outer zones of London. So rather than in Zone 1, it would be Zone 2. I started out in Brixton where a lot of young professionals wanted to live. A lot of lenders would stress test things and say, “As long as you've got 125% cover, we're happy.” I would often buy things on the basis of 250% or 300% cover.

Ian: Okay, so quite conservative then?

Rahul: Yes, so in the event that there were any changes in interest rates. I'm not as stressed, and I can manage the situation, I can still be cashflow positive. That's a model I still use today. Because otherwise, you can have something that will work in an environment at 2% interest rates, but then at 5% interest rates, you're underwater. I've maybe sacrificed having real estate assets that could have appreciated in capital value more than something else. But because their yields have been strong, I would say I've benefited from not having the same interest rate risk and the stress.

Ian: Okay.

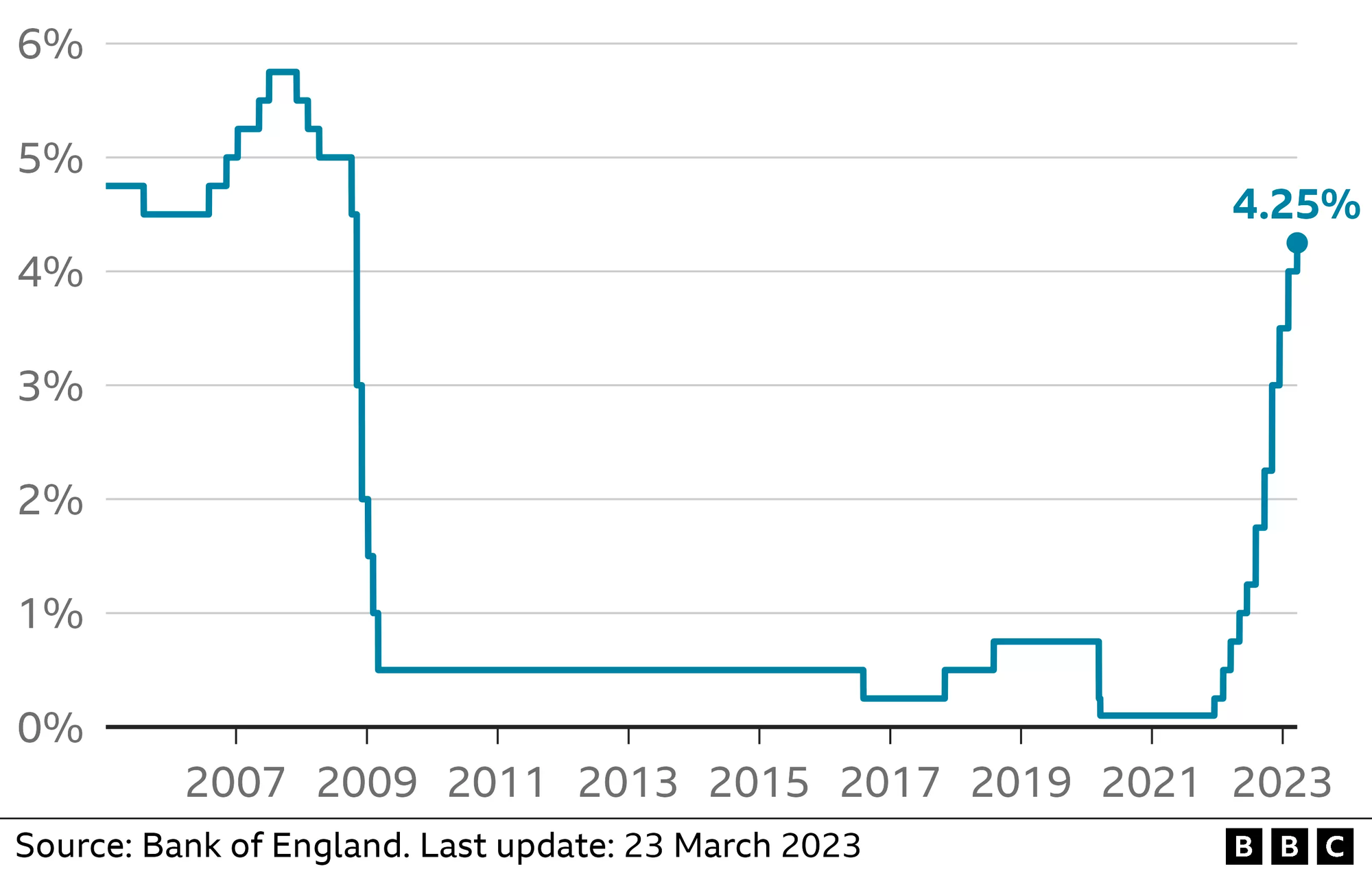

Rahul: But, you know, 2009 onwards, it became a low interest rate environment. So, I think that also maybe allowed people to make bad investments. When you've got cheap money, you can pick up an asset, which is yielding nothing. You can still make it cashflow positive. But obviously, when rates change, you're suddenly underwater.

Bank of England base rate

Ian: Yeah, maybe that period will be looked back on as being left for a little too long. It must have had some of knock on effects.

Rahul: Huge knock on effects. As a result of that period, you've got people owning assets which they just shouldn't be owning. In another environment, they would have to sell, and there would be a cycle, and other new entrants could then come into the market. So in the same way you have this term zombie companies, you could argue that it could be the same with real estate. There’s stuff that hasn't traded or hasn't been sold purely because interest rates are low. Is that the best and most efficient flow of capital?

Ian: Yeah, perhaps not. Today, we're in an environment where interest rates have been going up quickly. Maybe some people have been caught offside?

Rahul: Yes.

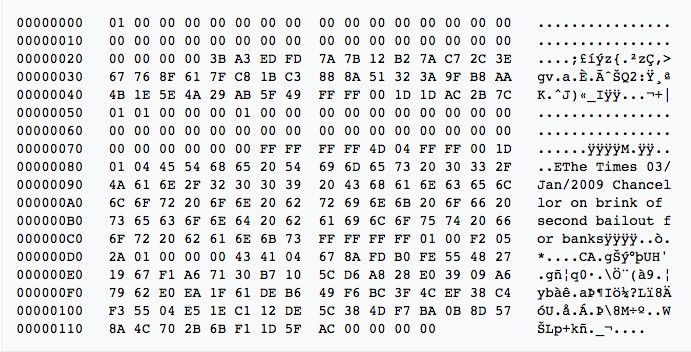

Ian: 2008 and 2009 will always be remembered for the global financial crisis, but in terms of bringing the conversation to Bitcoin, that came around at the same time right?

Rahul: I think, January 2009.

Ian: Sure. At what point did Bitcoin come up on your radar, and how did you start to become interested in it?

Rahul: I remember hearing about it in 2009 or 2010, but I didn't quite understand it. I didn't take the time to try and understand it either. I think a lot of the information I was getting was just from third party media sources. You know, them using words like ponzi, I didn’t have a good view of it at all.

It wasn't until 2018 that I started paying attention to Bitcoin. And then one step at a time, I felt that I needed to educate myself about it. I spent about a year learning about things before I was ready to actually buy any.

Ian: In your day to day, you're used to appraising or comparing different property investments. You know, working out if something's an opportunity or something to pass by. I imagine this experience was pretty helpful when appraising Bitcoin.

Rahul: Yes.

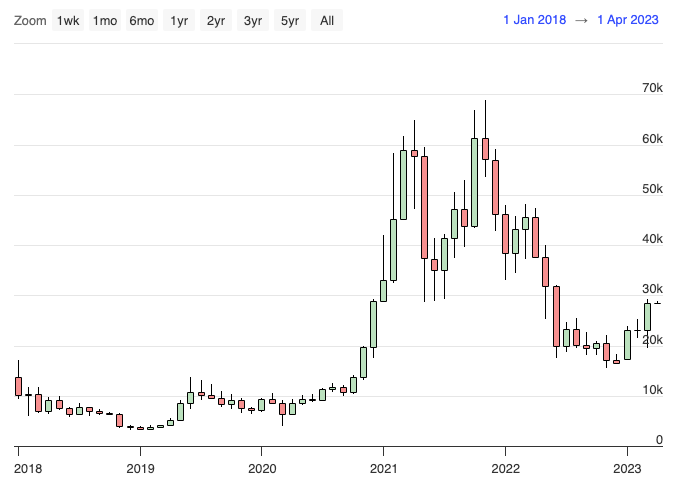

Ian: By 2018, Bitcoin had been and gone from the public eye several times. The price goes up, people talk about it, the price goes down and it goes into the background.

Rahul: Absolutely.

Ian: 2018 was around the time that 1 BTC first traded over £10,000. Suddenly, it's in mainstream headlines, but it's probably about illicit activity, or Bitcoin being a ponzi scheme as you mentioned. Even so, you're starting to get interested in it?

Rahul: Absolutely, as an alternative investment and as a store of value. At the time, I was also beginning to understand a little bit more about monetary policy and all the monetary expansion. The QE (quantitative easing), and the effects of that. And then a few years later, obviously COVID, and the government's response. I was starting to question things like scarcity.

Ian: The idea of scarcity seems to come up a lot when you study Bitcoin.

Rahul: Real estate, especially in London, can be scarce. There's that quote, which is often attributed to Mark Twain, which is, "Buy land, because they're not making any more of it." With fiat currency, they are definitely making more of it!

Ian: I think everyone can appreciate the idea of scarcity with housing in London.

Rahul: Demand is obviously increasing. You can also link back to the 80s, when we had the big bang, and deregulation, in the 90s. London was the financial centre of the world, because of regulatory arbitrage. Suddenly, you had wealthy people from all over the world coming here. That had a massive impact on real estate values, not only at the higher end. Now it's to the extent that rents aren’t affordable, even at the entry level in London. We've not just got working professionals, but demand from students as well. I think some of the changes with the universities in the 90s play into it too.

You had a typical Vice Chancellor salary in the 90s on £50k, today it’s like half a million pounds. And then what has happened with fees? It's funny how the fees have just gone up and up and up. You’d think education should be deflationary. The opposite way, I suppose.

Ian: Yeah, I suppose there are only so many apartments to rent, and so many university places. There's a lot of wealth and demand globally, and when that hits London it creates a feedback loop which impacts everyone.

Rahul: Yep.

Ian: So with the context of monetary policy, you're thinking wealthy people would be looking at Bitcoin in a similar way? Like a degree from a London uni, or an apartment in Zone 1 or 2, there's a limited amount to go around, it's scarce?

Rahul: That was one of my thought processes.

Ian: Okay.

Rahul: It wasn't initially my main thought process. Mainly it was look, by owning it, I'm going to be able to get deeper into understanding it. It took me a year to actually get to that process, which is quite different to buy-to-let, where I just didn't know as much about it.

Ian: Okay, that makes sense.

Rahul: So it's funny, with buy-to-let, I just went in with both feet. It might be an age thing. But no, I felt I needed to do a lot more homework before I even bought a small amount of bitcoin.

Ian: When you were starting out I imagine you had a bit more appetite for risk.

Rahul: I was free and single! But, I didn't see buy-to-let as a risk. I felt that not doing it was a risk. For me, the idea of passive income was important. I like to travel a lot. I didn't foresee my next 20 years being sat in an office. So that might have been revolutionary, like 20 years ago. Today I think more and more people are becoming open to those kinds of ideas as well.

Ian: Yeah, perhaps some people are always going to look for a way to be less reliant on their boss, and how they can build up a stronger financial position. There are a few young people out there that see Bitcoin as a great opportunity, maybe like getting into buy-to-let at the right time in the 2000s?

It's a new narrative for building wealth, but there are differences. An obvious one thinking of your experience with mortgages, they're all about leveraging assets?

Rahul: Yes, of course.

Ian: I don't think leverage and Bitcoin necessarily go very well together!

Rahul: You know what, I would 100% agree with you. I don't think I always had that view though. It's actually taken me the events over the last year to see it differently. Now I realise how dangerous mark to market leverage against something like Bitcoin is. If you'd have asked me a few years ago, I might have said if you leverage it to a conservative loan to value, you're okay.

Ian: So just like buy-to-let, right?

Rahul: Yeah. But I think the main difference here is, if I've got a mortgage loan, that's secured against a property for 25 years, that's not mark to market. So even if my property rental yield income goes down, or the capital value goes down, it doesn't breach a loan to value covenant, which allows the lender to call that money in. As long as I keep servicing my debt, I’ve got no obligation to pay that back until the maturity date. Whereas with Bitcoin, it’s immediately mark to market. If you fall below your loan to value covenant, you can be kicked out immediately.

Ian: Game over. Yeah, not so good.

Rahul: So, having leverage against bitcoin isn't a great idea. I think the best thing with anything, and this includes Bitcoin too, is don't put money into it unless you can take a minimum four or five year view. If it's money you think you might need, it's not the right time to invest it yet. If that's the case, then your first focus is on creating a rainy day fund. That way when you do finally buy something like Bitcoin, you're not stressed, and you never become a forced seller. You can always ride the market out and keep in sync with your original time horizon.

Ian: Agreed, so that anxiety is just not there.

Rahul: I'd say the same rules apply if you're investing in the stock market as well. When you've got your buffer, it's just a paper value. You're looking at the long term, and you can take the stress out of what the day to day price is.

Ian: Of course. In terms of the people that you deal with day to day in business, has Bitcoin ever come up in conversation? Or is it something that's completely in the background?

Rahul: I would say, it's the latter right now. It's quite surprising to me, given my clients and the people I interact with in the sector. Ninety percent are either real estate investors or developers, or they're working for investment banks or hedge funds. I'm surprised by how closed minded people within these sectors often are. The general consensus view quite often is that Bitcoin is a scam. But generally, with these people, you find none of them have actually delved into this or researched it. I don't know if that's because, you know, they're already within a system that kind of reinforces and benefits their values. I mean, if you're a banker, you've generally been used to an environment where you know that any sovereign state is going to allow you to privatise all your profits, but socialise any losses. You could argue whether that's actually a moral or not! I just feel maybe, when you've got a system which serves the existing status quo, it's quite difficult for people within that to want to challenge it.

Ian: That's interesting.

Rahul: That's not everyone, but I'll just say, I'm surprised by how many have that opinion.

Ian: Yeah, I wonder what, if anything, might change that. It could be as simple as the price. People take an interest because of greed, essentially. If they feel a fear of missing out, maybe then they want to get involved.

Rahul: Yes, but I'd argue there's a danger there. The last thing you want to be is a new entrant, who hasn't really taken the time to try and understand this properly.

Ian: Yeah, true.

Rahul: I think this happened in the recent bull market, where there was a lot of interest in it. You'd got a lot of people entering the space without doing their research properly, buying the peak of the market, and then liquidating.

Ian: Yeah, there’s a chance it's a good idea but poor timing for a lot of people.

Rahul: Yeah, I mean, not everyone will liquidate. I've experienced, I think, three significant drawdowns and that's only been in the space of like, four or five years.

Ian: Tough market.

Rahul: If I think about it, my average holding price could be higher than the price, even today. With hindsight, it's easy to wish I'd have bought at X price. I have to remind myself and say, you know what Rahul, by the fact that you've been through those cycles, this has fortified you, and you’ve got diamond hands!

Ian: Diamond hands! I know the saying.

Rahul: Yeah. So I feel that my conviction on Bitcoin is actually tested and really strong. I've already been through these ups and downs. If all I did, or all I'd seen is up, up up and never had a down, maybe there might be more scope for me to buckle and cave in. Yeah, and liquidate at the wrong time.

Ian: I suppose if you're in the red, even if you've told yourself that you should enter this with a long term view of four or five years minimum, it's not so easy. It sounds like you've done your homework, and you're cool headed about the whole thing. You're not putting money into Bitcoin that you need for something else.

Rahul: Yes, exactly. Actually, before I made my first Bitcoin purchase, I wrote a plan, and I keep referring back to it. Even though I put it down on paper, there's been times when it's actually been quite difficult to follow it. It went along the lines of: "Don't put any money into it unless you've got a sufficient cash reserves and liquidity for ‘X’ period of time."

Ian: Makes sense.

Rahul: "Once you’ve bought it, don't look at the price."

Ian: Easier said than done!

Rahul: Yeah, and then perhaps the third one was "repeat steps one and two!"

Ian: Well, it sounds simple. But you do hear a lot about volatility, alongside the usuals of illicit activity, environmental concerns, or that it’s a get rich quick ponzi scheme!

Rahul: Well, it's definitely not that, and one thing I'm a big advocate for is getting rich slowly. Because there's no kind of fast track to anything. Like most things in life, you've got to put in the work. That work doesn't need to be arduous, it's just consistency. So, rather than overextending yourself in something, why not say, you know what, let's cut and do 50% of that for now. But, it's about time as we were mentioning before, isn't it? Investment horizons relating to time. Time is actually the original currency in a way, it can't be debased or manipulated by governments. You can't print more of it!

Ian: Yeah for sure.

Rahul: I think sometimes the danger with any investment, whether it's property, equities, or bitcoin, is having a low time horizon. Thinking that there's a shortcut to something, and there just isn't. There are also a lot of scammers in the space that are preying on people's low time horizon basis.

Ian: Yeah, I suppose time is probably why many people get interested in investing in the first place, to move away from the hamster wheel and have more time. A lot of people wish they had more time to spend with their family, or their community.

Rahul: I would say you’ve got it spot on. For me, and I think for most people, when they think about it, the idea of building wealth, it's not necessarily for materialism, it's so you can own your own time. I think there's nothing more powerful than that. When we're children, we're always waiting until we're 18 before we can do things, and then we've got more self-sovereignty. Unfortunately, we’re coached into a model where as an adult you do seem to have to go on a sort of hamster wheel. In reality, we want to escape from that as early as possible. The only way we can do that is by owning our own time.

Ian: Agreed. So the younger Rahul probably had that in mind back in the day, working as a mortgage broker whilst starting out with the buy-to-let portfolio. Building wealth and creating some passive income.

Rahul: All those things were by accident as well by the way!

Ian: Sure, but it sounds like you had a clear intention! You didn't want to stick to the nine to five, you wanted to have more control over your own time.

Rahul: Yeah. I was really into travel, backpacking. I was going on adventures in India, Thailand, Vietnam and Colombia, so that's what my whole ethos was at that time - passive income was allowing me to travel.

Ian: With passive income, that's a popular critique from some investors about Bitcoin. There's no yield, so it's not a real investment. Maybe it's more of a speculation. Also, we've discussed how leverage might not really fit with Bitcoin either.

Say you're fortunate enough to have some decent positive cash flow, and you're trying to build wealth today - do you think Bitcoin is a compelling option?

Rahul: 100%, as long as you follow the previous principles I mentioned, of not putting too much money into it, and making sure you're also looking at building up a reserve fund in cash. But yeah, absolutely.

"A speculator doesn’t allocate capital in order to grow a business or create something. He simply takes advantage of distortions in the market to increase his personal share of existing wealth. Most speculative opportunities have political roots, taking advantage of distortions created by laws, regulations, taxes, or other government action."

Doug Casey

Ian: And would the property side of things play into it in the same way today?

Rahul: Honestly I think it would be very difficult to follow the same path today.

Ian: Interesting.

Rahul: For one there's the interest rate side, but it wouldn't be unreasonable to expect a return to a low interest rate environment longer term. The main thing has been taxation changes.

Ian: I heard about that.

Rahul: There was a big change a few years ago, mortgage interest is no longer a tax deductible cost for a landlord on properties held in personal names. Now, to me, that's really an attack on individual freedom, they're almost trying to take a tool away from the average person on being able to build wealth, because these changes aren't aimed at corporates, so corporates are still allowed to do this. So it almost feels like the government is really disincentivizing and penalising private wealth creation for individuals.

Ian: Yeah, I can see that.

Rahul: Previously, buy-to-let allowed people from quite a few different walks of life to build wealth. You didn't necessarily have to come from money to get involved.

Ian: It does sounds like at the point in time you described (early 2000s), buy-to-let was a great opportunity and quite accessible too?

Rahul: Yeah.

Ian: Well, if you could afford a deposit.

Rahul: Yes. Sometimes people would club together for it. So, yeah, I think that's a sad thing. I don't know what the government intentions are, or what the real rationale there was. It seems like they want to go down a model in future where they're encouraging more of these PRS (Private Rented Sector) models . Almost like student accommodation schemes for private flats, but I don't know who wants to live in those.

It’s a homogenised product, and I think housing is a very personal thing. People like having multiple different options on the table. I think one of the consequences of this policy is they've got a lot of landlords selling up their stock. There's been less supply in the market. At the same time, there's been increasing demand. Inflation on rent, particularly in London, has been horrendous. So there have been a lot of unintended consequences from the change. It makes it difficult to do the traditional buy-to-let investment approach. But you know what, when you have restrictions like that, you can always find new approaches. But I don't think it's as easy as it used to be.

Ian: Okay, so it's not game over, but much harder given the tax situation. It could be harder than ever to save up a deposit too.

We've covered quite a bit there, from buy-to-let through to Bitcoin and back, let's close things there. Thank you!